To print this article, all you need is to be registered or login on Mondaq.com.

Application of Part IVA in Minerva Financial Group: Focusing on

Commercial Substance over Tax Effects

Introduction

In Minerva Financial Group Pty Ltd v Commissioner of

Taxation [2024] FCAFC 281, the Full Federal Court

reversed the Federal Court’s decision in finding that

Australia’s general anti-avoidance rules (Part IVA) did not

apply to income distributions made by a trust within a stapled

group structure. This article analyses the Full Federal Court’s

reasons for their judgment, highlighting the emphasis placed on the

commercial substance over mere tax outcomes obtained.

Background

The facts can be summarised as follows:

- The appellant, Minerva Financial Group Pty Ltd is a member of

the Liberty group. - Prior to 2007, the Liberty group had a history of establishing

securitisation trusts. The units in those trusts were wholly owned

by a company in the Liberty group. - In 2007, the Liberty group undertook a restructure in

anticipation of an initial public offering (IPO) of stapled

securities, whereby it would have a ‘trust silo’ and a

‘corporate silo’. - Minerva Holding Trust (MHT) was established to hold all of the

units in new securitisation trusts going forward. MHT issued an

ordinary unit to the ‘trust silo’ and a special unit to the

‘corporate silo’. - The IPO was postponed and in the 2012 to 2015 income years,

income earned by MHT (from the securitisation trusts) was mainly

distributed to the ‘trust silo’ (via the ordinary unit) and

then to the ultimate non-resident shareholders. Further MHT lent

amounts it received as distributions from the securitisation trusts

to the ‘corporate silo’. - The tax consequence was that profits earned by the ‘trust

silo’ were subject to a withholding tax of 10 percent rather

than a corporate tax rate of 30 percent (if the profits from the

securitisation trusts had instead been earned by the ‘corporate

silo’ as was the case prior to 2007).

The Commissioner sought to apply Part IVA to include amounts in

the appellant’s assessable income for the 2012 to 2015 income

years, arguing that the income would otherwise have been

distributed to the corporate silo, as it had prior to 2007.

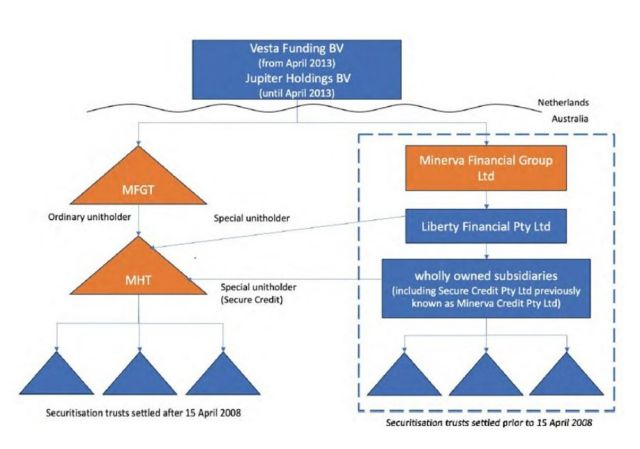

Diagram Explaining Full Federal Court Case

Source: Minerva

Financial Group Pty Ltd v Commissioner of Taxation [2024] FCAFC

28 at paragraph 18

Application of Part IVA

For Part IVA to apply, it must be concluded a party entered into

a scheme(s) with the dominant purpose (having regard to the

objective factors in s.177D of the Income Tax Assessment Act 1936

(Cth)) of gaining a tax benefit.

The primary judge had held that Part IVA applied to two of three

schemes asserted by the Commissioner – the common features of

these schemes being:

- The choice made by the taxpayer, as trustee of MHT, not to

exercise its discretion to distribute any more than a nominal

amount of MHT’s distributable income to the ‘corporate

silo’ via the special unit and to distribute the majority of

the income to the ‘trust silo’ via the ordinary unit;

and - The lending by MHT of the amounts it received as distributions

from the securitisation trusts to the ‘corporate

silo’.

Importantly, the primary judge held that Part IVA did not apply

to the 2007 restructure itself.

The Full Federal Court found that the primary judge had not

considered the objective factors in s.177D appropriately and

instead had focused on the subjective purpose of the trustee of

MHT. In particular, the primary judge had held that there was a

dominant purpose of obtaining a tax benefit because the taxpayer

did not proffer a commercial reason why they had only distributed

nominal amounts to the ‘corporate silo’.

In finding that there was no dominant purpose of obtaining a tax

benefit, the Full Federal Court observed:

- There was nothing extraordinary about distributions flowing in

accordance with the terms of the trust constitution. - Setting-off intra-group balances in ledger account entries was

also not unorthodox for transactions within a commonly owned

group. - The mere fact that the structure diverged from the

pre-restructure course of conduct was of no relevance, particularly

as the Commissioner did not seek to challenge the primary

judge’s conclusion that Part IVA did not apply to the 2007

restructure itself. - The flow of income distributions from MHT to the ‘trust

silo’ merely resulted from the ‘trust silo’ holding the

ordinary units in MHT. - The loans by MHT to the ‘corporate silo’ did not create

a mismatch between the form and the substance of the scheme. - The distribution of income to the ‘trust silo’ (and

subsequently its non-resident owners) had real economic and

financial consequences that would not have flowed to those owners

if income had instead been distributed to the ‘corporate

silo’, by for example, enabling the repayment of debts owed to

the ‘corporate silo’.

Overall, the Court held that no objective factor clearly pointed

to a dominant purpose of tax avoidance.

Conclusion

The emphasis of commercial purpose over tax benefit alone,

reinforces Part IVA’s objective analysis requirement. Part IVA

cannot simply be triggered by the obtaining of tax benefits.

Commercial realities and consequences for the relevant parties

matter greatly in the Part IVA balance.

Once it was accepted that the 2007 restructure did not

constitute a scheme entered into for the dominant purpose of

obtaining a tax benefit, the Commissioner’s arguments comparing

the post-restructure state of affairs to the pre-restructure tax

outcomes were no longer relevant. This case provides helpful

guidance for taxpayers seeking to restructure who have a clear

economic and commercial rationale for doing so.

Footnote

1. https://www.judgments.fedcourt.gov.au/judgments/Judgments/fca/full/2024/2024fcafc0028.

Originally published 08 April 2024

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Tax from Australia

#Analysis #Full #Federal #Court #Decision #Australian #Tax #Case #Withholding #Tax